flow through entity irs

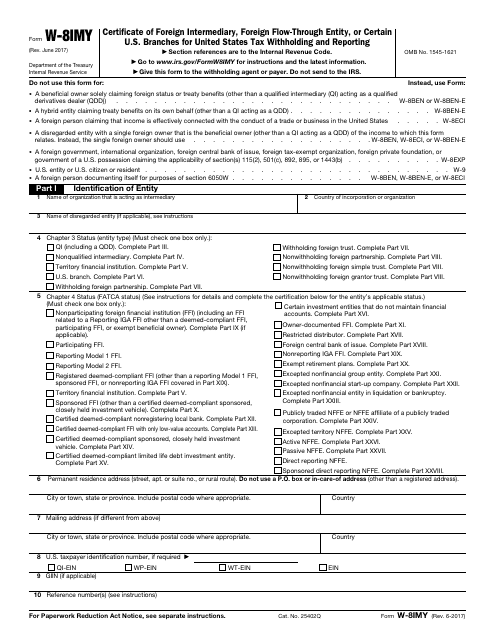

Payments Made to Foreign Intermediaries and Foreign Flow-Through Entities. The resulting avoidance of.

A pass-through entity also known as a flow-through entity is not a particular business structure but a tax status enjoyed by any business that does not pay corporate tax.

. The most typical function of a flow-through entity is to ensure that its owners and investors are not subject to double taxation which is the case for C-corporations. However because this technical issue may prevent some taxpayers from submitting a flow-through entity tax payment on or before March 15 2022 special relief is necessary. Hence the income of the entity is the same at the income of the owners or investors.

Flow-through entities FTEs affect an individuals Foreign Tax Credit FTC by impacting foreign source gross income foreign s ource taxable income worldwide gross income worldwide taxable income and foreign taxes available for credit. These parties then report the gains and losses on their own tax returns. If a reduced rate of withholding under an income tax treaty is claimed the claimant must be able to treat as a flow-through entity any entity between you and the claimant.

A flow-through is a business entity that may generate or receive taxable income but which pays no income tax in its own right. Flow-Through Entity FTE Tax Credit. The Form W-8IMY Certificate of Foreign Intermediary Foreign Flow-Through Entity or Certain US.

The owners or shareholders of the business pay taxes on their share of the businesss income at their individual tax rates. We believe that deferred taxes related to an investment in a foreign or domestic partnership and other flow-through entities that are taxed as partnerships such as multi-member LLCs should be based on the. ASC 740 contains minimal explicit guidance on the accounting for deferred taxes associated with investments in partnerships or other flow-through entities eg LLCs.

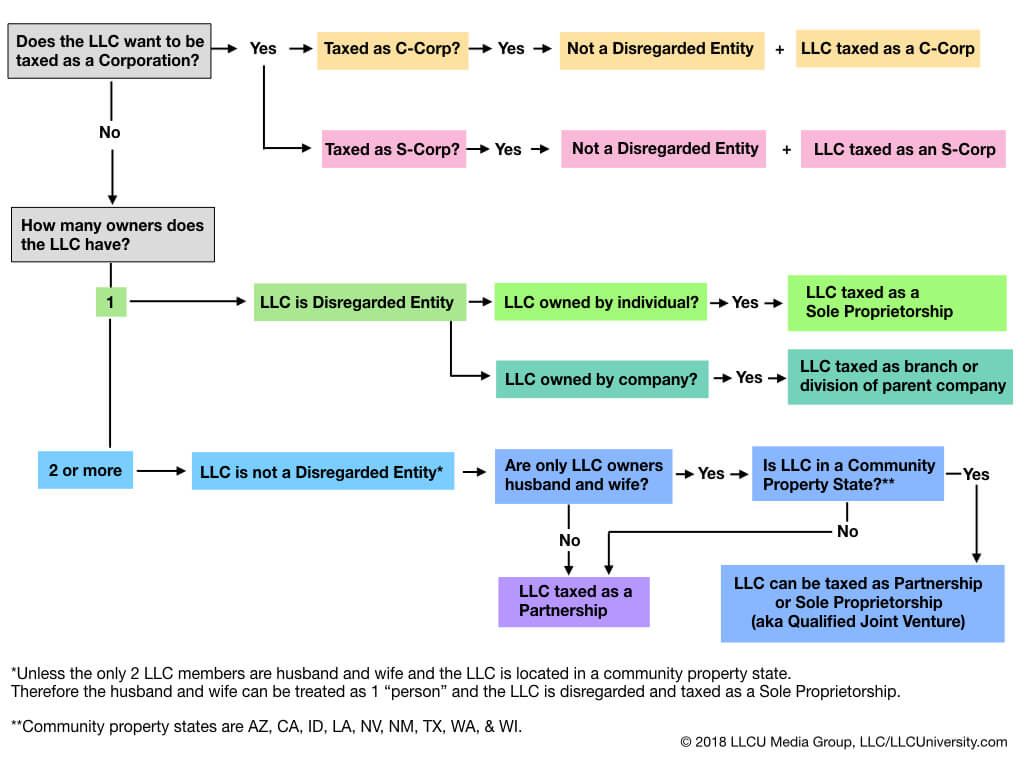

Common Types of Pass-Through Entities. Flow-through or pass-through entities are not subject to corporate income tax though the Internal Revenue Service does require that they file a K-1 statement annually. In this legal entity income flows through to the owners of the entity or investors as the case may be.

2021 Flow-Through Entity FTE annual return payments must be made timely to avoid penalty and interest. The entity calculates taxable income before the owners compensation. The structure helps avoid double taxation which is when an income from the same source is taxed both at a corporate and personal level.

Accordingly for taxpayers who have registered within MTO as of March 15 2022 but receive the message above the Michigan Department of Treasury will regard any payment. The title of this concept unit as referred to by the IRS is. IRS new media.

The majority of businesses are pass-through entities. A flow-through entity is a business entity is which income of the entity passes on to the investors or owners of the entity. Tiered Entities Material participation is based on the.

The determination of whether an entity is fiscally transparent is made on an item of income basis that is the determination is made separately for interest dividends royalties etc. Flow-through entities can affect an individuals foreign tax credit FTC with regard to foreign-source gross income foreign-source taxable income worldwide gross income worldwide taxable income and foreign taxes available for credit. General FTE Tax Credit.

Flow-through entities are taxed only once at the individual level. View FTE Business Tax FAQ. Read the concept unit on the.

FTE Tax Credit FAQs. The Flow-through Entities Tax section is a compilation of alerts and articles written by members of the ICPAS Flow-through Entities Tax Committee. Its gains and losses are allocated or flow through to those with ownership interests.

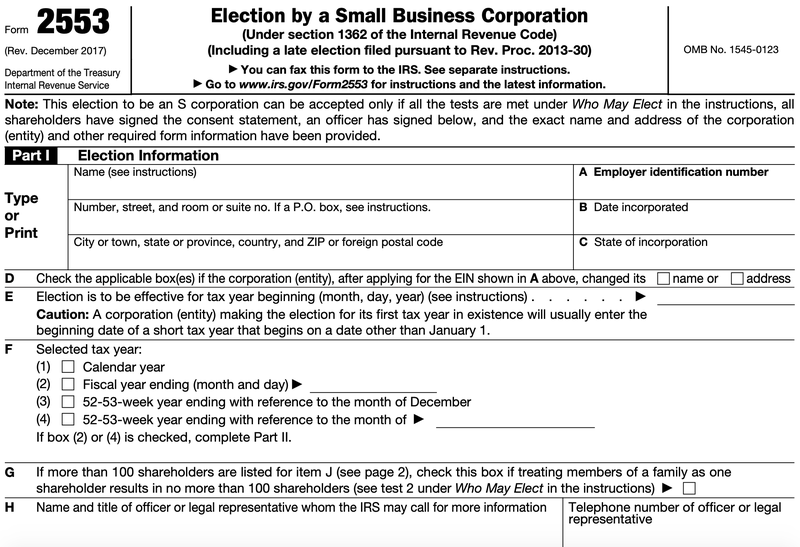

A flow-through entity also known as a pass-through entity or fiscally-transparent entity is a legal business entity where its profits flow directly to the investorsowners and only the investors or owners are taxed on the income. Partner of a partnership must report the partners distributive share of the partnerships gains income deduction s losses or credits on. The following types of common flow-through entities may elect to pay the flow-through entity tax in Michigan.

Branches for United States. Passive Activity A trade or business in which the taxpayer. Flow-Through Entity FTE Tax Credit.

More states considering passthrough entity taxes February 2021 IRS allows entity-level taxes as SALT deduction limitation workaround November 2020 California Senate bill proposes pass-through entity tax January 2021 Connecticut enacts responses to federal tax reform affecting corporations pass-through entities and individuals June 2018. However the late filing of 2021 FTE returns will be accepted as timely if filed within 6 months of the due date. Every profit-making business other than a C corporation is a flow-through entity including sole proprietorships.

FTE Tax Credit FAQ. Rules for Flow-Through Entities. Typically businesses are subject to corporate tax while business owners also have to pay a personal income tax.

Participate Any rental without regard to whether or not the taxpayer materially participates A single entity could have more than one activity. Flow-through entities effects on FTC. The tax rate for flow-through entities is the same as the individual tax rate.

Pass-through entities also called flow-through entities roughly follow the same tax-paying process. FTE Tax Credit and Michigan IIT Return Form MI-1040 FTE Tax Credit and Michigan Composite IIT Return Form 807. Limited liability companies LLCs that file federal income tax returns as partnerships Partnerships including limited partnerships limited liability.

A pass-through entity also called a flow-through entity is a type of business structure used to avoid double taxation. Payments made to a foreign intermediary or foreign flow-through entity are treated as made to the payees on whose behalf the intermediary or entity acts. As well as links to websites and other resources of interest to the flow-through entities tax communityFollow the links below for more information on these topics.

There are several advantages to operating a business as a flow-through entity.

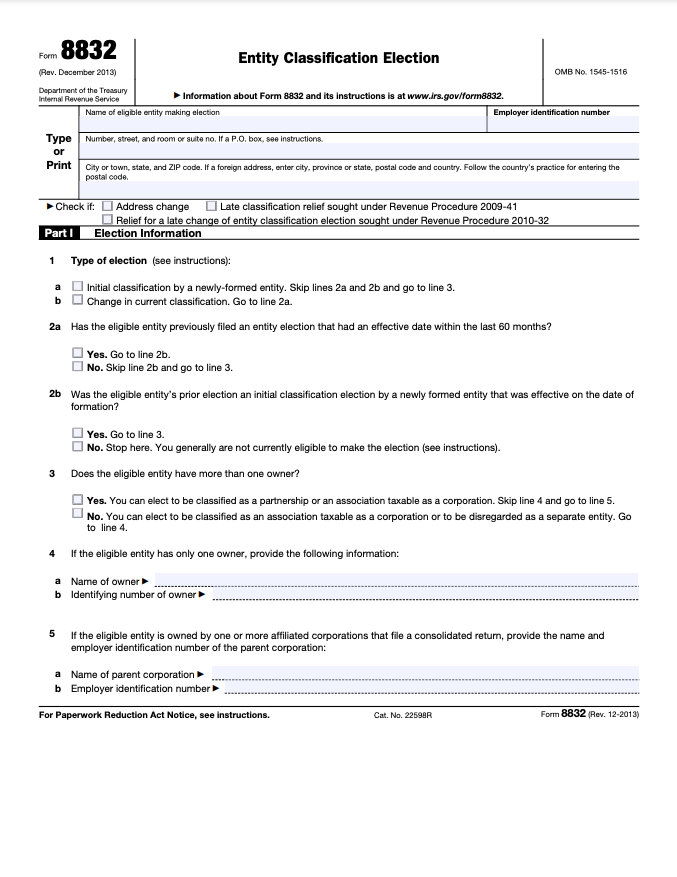

Form 8832 And Changing Your Llc Tax Status Bench Accounting

Irs Form W 8imy Download Fillable Pdf Or Fill Online Certificate Of Foreign Intermediary Foreign Flow Through Entity Or Certain U S Branches For United States Tax Withholding And Reporting Templateroller

Llc Taxed As C Corp Form 8832 Pros And Cons Llc University

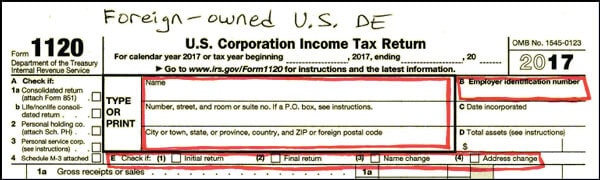

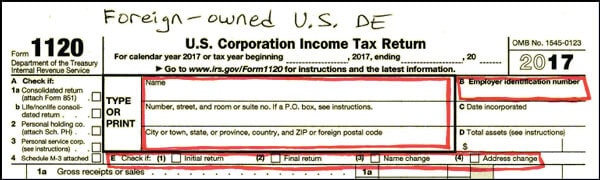

Form 5472 Foreign Owned Us Single Member Llcs Llc Univeristy

8 19 1 Procedures And Authorities Internal Revenue Service

How Should An Llc Fill Out A W 9 Form Correctly Ssn Vs Ein W9manager

Irs Filing Requirements For Check Book Ira

Irs Form W 8imy Download Fillable Pdf Or Fill Online Certificate Of Foreign Intermediary Foreign Flow Through Entity Or Certain U S Branches For United States Tax Withholding And Reporting Templateroller

How Should An Llc Fill Out A W 9 Form Correctly Ssn Vs Ein W9manager

7 Irs Rules That May Make Your Trust A Disregarded Entity Regnum Legacy

A Beginner S Guide To Pass Through Entities The Blueprint

4 31 2 Tefra Examinations Field Office Procedures Internal Revenue Service

Do Llcs Get 1099 S During Tax Time Fundsnet

How To Choose Your Llc Tax Status Truic

What Is A Disregarded Entity And How Are They Taxed Ask Gusto